Weekly Review

1. Price Trends

Seamless Pipes: The national average price for 108×4.5mm seamless pipes dropped 23 yuan/ton WoW to 4,314 yuan/ton. Regional declines were observed in key markets.

Raw Materials: Pipe billets weakened overall. Prices held steady in Shandong but fell 40 yuan/ton in Jiangsu.

Mill Adjustments: 34 sampled mills cut ex-factory prices by 30–100 yuan/ton.

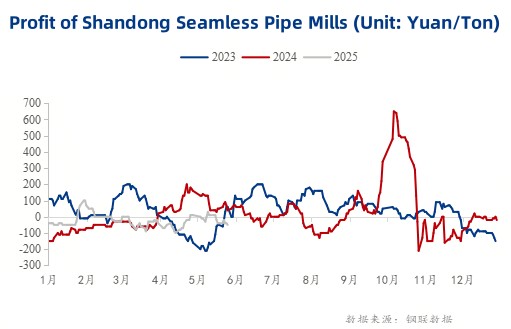

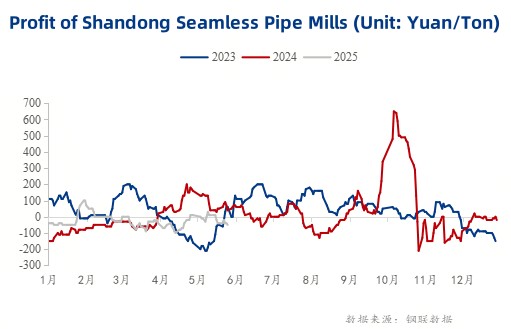

2. Profitability

Shandong Mills: Average losses deepened to -50 yuan/ton (down 10 yuan/ton WoW).

Jiangsu Mills: Profits rose 30 yuan/ton WoW to 100 yuan/ton.

3. East China Spotlight

Costs: Shandong/Jiangsu pipe billets fell 90/40 yuan/ton WoW, prompting local mills to cut pipe prices by 30–100 yuan/ton.

Prices: Shanghai and Nanjing held steady (108×4.5mm at 4,290/4,170 yuan/ton), while Hangzhou dropped 30 yuan/ton to 4,270 yuan/ton.

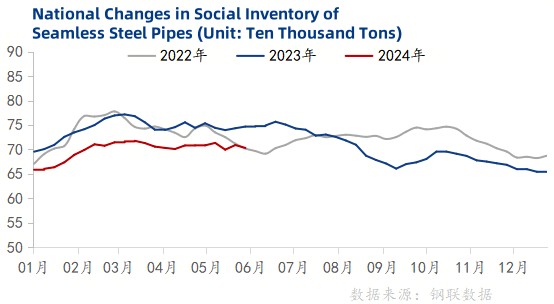

Inventory & Demand: Regional social stocks dipped 5,400 tons WoW. Monsoon weather and off-season lethargy kept transactions muted, with traders adopting wait-and-see stances.

Outlook: Prices expected to remain soft and stable short-term.

Next Week’s Forecast

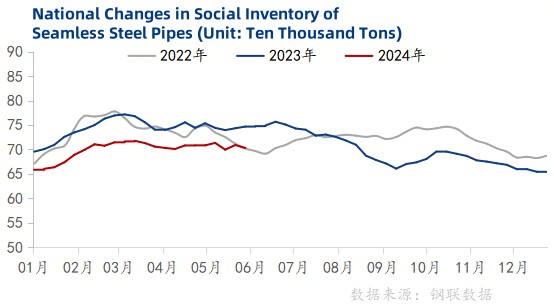

1. Inventory Dynamics

Social Stocks: 703,100 tons (down 5,900 tons WoW).

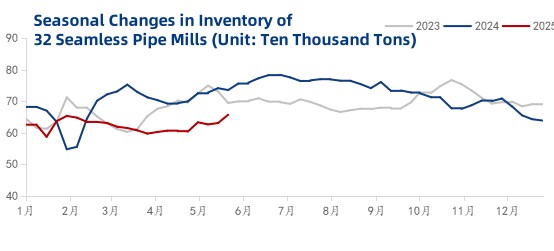

Mill Inventories:

Finished goods: 657,100 tons (↑26,400 tons WoW).

Raw materials: 305,700 tons (↑14,000 tons WoW).

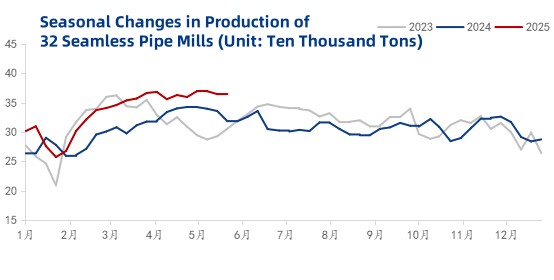

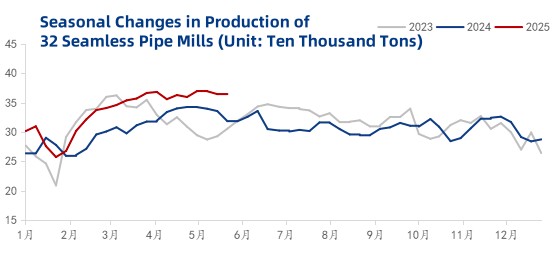

2. Supply Outlook

Output: 363,300 tons (↓1,300 tons WoW).

Utilization: 78.94% (↓0.28% WoW).

Operating Rate: 60% (flat WoW).

Trend: Rising mill inventories and squeezed profits may further curb production.

3. Market Drivers

Costs: Weak futures markets and lower billet prices reduced production costs.

Demand: Downstream consumption remains sluggish amid seasonal headwinds.

Sentiment: Traders turned cautious due to rainy weather and bearish expectations.

4. Price Projection

Seamless pipe prices are likely to trend moderately downward next week, pressured by soft costs, high mill inventories, and tepid demand.